Johannesburg – The South African used car market continues to gain momentum, showing growth on the moon (mama) and year-over-year (YOY) in March 2025, renewed consumer confidence as it moved into the second quarter of the year.

According to the latest AutoTrader data, 29,896 used vehicles were sold last month, marking +9.6% increase and a mama rise of +3.5%.

The increase in sales could be partly due to the fact that March had more sales days than February.

The Ford Ranger remains a favorite used car in South Africa.

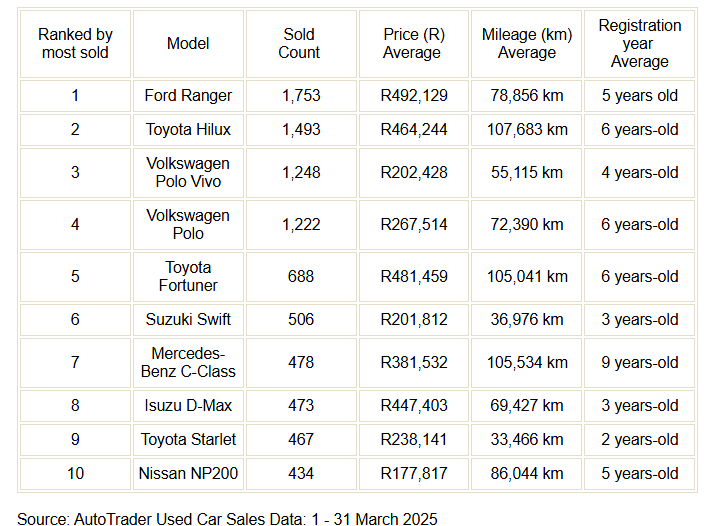

The top 10 bestselling used cars held their positions, but there were some notable changes to the rankings.

Polo Vivo, for example, missed his more expensive brother, Polo, and won the third spot on the podium.

This shift coincides with an increase in preference for more affordable vehicles, but the Mercedes-Benz C-Class has defied the trend last month by climbing three spots to become the country's seventh-most-selling used car.

Meanwhile, the Nissan NP200 dropped three spots to 10th place.

Despite the strong monthly performances of the C class, the previous rankings were 6th.

It is important to note that these sales exclude the Mercedes-AMG C-Class model.

In the C-Class, it was the only car on the top 10 list to record a decline in sales compared to March 2024, with a 9.6% decline in year-over-year.

In contrast, Toyota's starlet ranked 9th, saw an astonishing year-over-year of +78.2%, up from 16th last year.

In March 2025, the total used cars sold was R124.8 billion, reflecting an increase of +10.9% compared to March 2024 (R11.129 billion), and an increase in MOM of +3.81% compared to February 2025 (R120.2 billion).

The average price for used cars saw an increase of R417,688, showing a Mama's R1,205 increase and a year-over-year rise of R4,683.

“The strong performance of the used car market in March highlights a continuous shift towards more affordable and reliable cars,” commented George Mienie, CEO of AutoTrader.

“While brands like Toyota, Volkswagen and Ford remain at the forefront, the growing popularity of models like Polo Vivo, Suzuki Swift and Toyota Starlet shows a clear demand for value-driven choices.

“While premium brands face several challenges, overall growth speaks to the market's resilience and ability to adapt to consumer preferences.”

Ford may lead at the model level, but Toyota remains the top selling used car brand in South Africa.

The Japanese giant sold 5,228 vehicles in March, reflecting a +3% increase in mama and +18% increase in the previous year.

Volkswagen enjoyed a +7% mama increase, with 4,294 units sold, but growth before +15% was slightly behind Toyota.

Ford was third, with 3,224 units, representing a year-over-year rise of +5% moms and +12%.

Of the top 10 brands, three iterations have declined, two of which are premium brands, highlighting the growing consumer demand for more affordable and fuel-efficient vehicles.

BMW experienced a year-on-year decline of -6% in sales, while Mercedes-Benz fell -3%. Kia faced the biggest recession, with sales down -22% compared to March 2024, but sales in later years in February 2025 were already down -17%.

However, some brands have shown strong growth, especially the top three. Suzuki, for example, recorded impressive growth, up 31% year-on-year, but mothers fell by 4%.

Rangers continue to dominate at the forefront of models, with 1,753 units on sale in March 2025.

Toyota Hilux took third place with 1,493 units sold and 1,248 units sold.

Polo Vivo's Yoy growth is particularly impressive, with an increase of +47%.

As for variants, the Polo vivo 1.4 remains the most popular, with 976 units on sale followed by the 730 units of Polo 1.0TSI.

The Hilux 2.8 GD-6 (644), Ranger XL (550), and Hilux 2.4 GD-6 (517) outperform the five most popular used variants.

Top 10 sold second-hand models in March 2025